Ethereum was cheaper than expected in 2020, and rollup decentralization was slower than promised in 2021. Those two realities are forced the ecosystem to rewrite what “a layer-2” is for.

Vitalik Buterin’s recent post on Ethereum Research bluntly frames the shift: the original vision of layer-2 (L2) blockchains as “branded shards” of Ethereum is no longer viable, and the ecosystem requires a new path.

However, this isn’t abandonment. Instead, it is a re-tiering of expectations and a sharper definition of what different types of rollups are actually building.

The question now is the new job description, since the premise underlying the rollup-centric roadmap has weakened.

Stage 2 is scarce

L2BEAT provides the clearest framework for understanding rollup decentralization through its Stages system.

Stage 0 denotes that training wheels remain in place, with meaningful trust assumptions persisting.

Stage 1 represents partial decentralization with stronger escape hatches and proof guarantees, but still meaningful upgrade or governance trust.

Stage 2 is the “no training wheels” milestone, in which critical safety properties are enforced by code rather than by discretionary actors.

The current distribution of value secured across the L2 ecosystem indicates this. According to L2BEAT’s rollup scaling summary, approximately 91.5% of the listed value sits in Stage 1 rollups, 8.5% in Stage 0, and roughly 0.01% in Stage 2.

The top three rollups by value account for roughly 71% of the total, indicating that “Stage 2 progress” largely depends on the decisions of the largest few projects, rather than on what smaller experimental chains attempt.

The core blocker is whether the proof systems can be overridden and whether upgrades face strong delays and constraints.

Upgrade discretion remains common among the largest rollups, and moving beyond it has proven slower and more difficult than anticipated by the 2020-2021 optimism.

Some projects have explicitly stated that they may not wish to proceed beyond Stage 1, citing not only technical constraints related to zkEVM safety but also regulatory requirements that require absolute control.

That’s a legitimate product decision for certain customer bases, but it clarifies that those chains are not “scaling Ethereum” in the sense the rollup-centric roadmap originally meant.

| Project | Stage | TVS ($) | Proof type | Upgrade key / security council present? | Notes |

|---|---|---|---|---|---|

| Arbitrum One | 1 | 16.16B | Optimistic | Yes | Emergency path can skip delays |

| Base Chain | 1 | 10.99B | Optimistic | Yes | Upgrades approved by multiple parties; no delay |

| OP Mainnet | 1 | 1.88B | Optimistic | Yes | Security council instant upgrade power |

| Lighter | 0 (Appchain) | 1.27B | Validity | Yes | 21d delay, emergency can go to 0 |

| Starknet | 1 | 676.17M | Validity | Yes | Security council can upgrade with no delay |

| Ink | 1 | 523.71M | Optimistic | Yes | Security council + foundation approvals; no regular delay |

| Linea | 0 | 492.93M | Validity | Yes | Multisig can upgrade with no delay |

| ZKsync Era | 0 | 417.07M | Validity | Yes | Emergency board can bypass upgrade delays |

| Katana | 0 | 297.94M | Validity | Yes | security council can remove the upgrade delay |

| Unichain | 1 | 168.81M | Optimistic | Yes | no exit window for regular upgrades; instant powers |

Why the constraints changed

The Oct. 2, 2020, post “A rollup-centric Ethereum roadmap” on the Fellowship of Ethereum Magicians laid out the original thesis.

Gas prices were climbing, some applications were being forced to shut down, and the conclusion was that the ecosystem would be “all-in on rollups” for the near and medium term.

Base-layer scaling should prioritize data capacity for rollups, and users would increasingly live on L2.

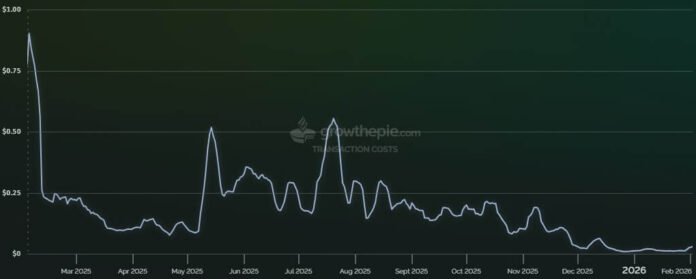

Two hard facts have shifted since then. First, L1 is substantially cheaper at present. Etherscan shows a seven-day average transaction fee of around $0.35 and gas snapshots in the fractions of a gwei.

On Jan. 16, Ethereum recorded an all-time high of 2,885,524 transactions in a single day. The narrative is “busier and cheaper,” exactly the opposite of the 2020 crisis that motivated the rollup-centric roadmap.

Second, L1 execution capacity is rising. Ethereum’s block gas limit was raised to approximately 60 million after broad validator signaling in late 2025, up from the long-standing 30 million limit.

At roughly 12-second blocks, 60 million gas translates to approximately 5 million gas per second.

Aspirational community discussions have mentioned targets as high as 180 million gas, which would represent a threefold increase, though that remains directional rather than committed.

The clean interpretation: the 2020 premise that “L1 can’t scale for most users” is weaker in today’s fee regime. This creates room for L2s to be a spectrum of security and sovereignty trade-offs rather than all being near-identical “shards” competing solely on price.

L2s as a spectrum, not clones

Buterin’s proposed reframing treats L2s as occupying a full spectrum.

On one end are chains backed by the full faith and credit of Ethereum, with unique properties, not just EVM clones but also privacy-focused systems, non-EVM execution environments, or ultra-low-latency sequencers.

At the other end are options with varying levels of Ethereum connectivity that users and applications can choose based on their specific needs.

The new minimum bar is straightforward: if you handle ETH or Ethereum-issued assets, reach at least Stage 1.

Otherwise, you’re a separate L1 with a bridge, and should call yourself that. The differentiation bar is harder: be the best at something other than “cheap EVM.”

Examples Buterin cites include privacy, efficiency specialized to a particular application, truly extreme scaling beyond even an expanded L1, fundamentally different designs for non-financial applications such as social or identity systems, ultra-low-latency sequencing, or features such as built-in oracles or decentralized dispute resolution that aren’t computationally verifiable.

The mechanism that might facilitate this is still under investigation. A “native rollup precompile” would enable Ethereum to verify a standard zkEVM proof within the protocol.

For rollups that are “EVM plus extras,” this means the canonical EVM verification occurs trustlessly at the protocol level, and the rollup only needs to prove its custom extensions separately.

This could enable stronger interoperability and pave the way for synchronous composability, in which contracts across different rollups can interact within the same transaction. Yet, it remains a research trajectory, not a deployed feature.

The Jan. 16 post “Combining preconfirmations with based rollups for synchronous composability” and the Feb. 2 post “Synchronous composability between rollups via realtime proving” lay out the design space but don’t represent shipped protocol changes.

Three buckets emerging

If this reframing takes hold, expect rollups to split into clearer categories.

The first bucket is Stage 2-chasing settlement rollups that maximize Ethereum security inheritance.

These projects aim to achieve code-enforced guarantees with minimal discretionary governance, treating “scaling Ethereum” as their core mandate.

The second bucket is regulated or controlled execution environments.

These optimize for compliance, permissioning, or specific institutional requirements. They may never progress beyond Stage 1 by design, and they should market that control honestly as a feature rather than pretending to offer full decentralization.

The third bucket is specialized chains optimized for latency, privacy, app-specific execution, or non-financial use cases.

Privacy rollups using zkProofs to hide transaction details, ultra-low-latency sequencers for trading applications, or social and identity systems with fundamentally different state models all fall within this category.

These don’t need to be EVM-compatible or even financial to justify their existence, they need to provide value that their users can’t get elsewhere.

Projects such as Arbitrum One, Optimism, Base, zkSync Era, and Starknet will each need to decide which category they’re pursuing. The ecosystem is large enough to support all three, but the assumption that every L2 performs the same function is fading.

What changes for users and builders

For users, the burden shifts to understanding guarantees. Escape hatches, upgrade delays, proof systems, and censorship resistance become product differentiators rather than assumed properties.

Wallets and interfaces will need to label trust assumptions more explicitly, and the L2BEAT Stages framework aims to make these assumptions legible.

For builders, “cheap EVM” is commoditized. Differentiation moves to privacy and custom virtual machines, ultra-low-latency sequencing, app-specific throughput optimizations, non-financial applications in social, identity, or AI contexts, or compliance and permissioning as an explicit product, without claiming it’s “Ethereum scaling.”

For the broader market narrative, expect a louder debate about whether L2s “inherit Ethereum security” in practice rather than as an aspiration.

The critique is already a talking point among rival L1 proponents, and the ecosystem’s acknowledgment that many large rollups remain at Stage 1 with discretionary governance gives that critique greater traction.

Is an L2 revolution about to start?

Ethereum is unlikely to see an L2 revolution. Instead, it will witness a re-tiering.

The rollup-centric roadmap assumed that L2s would be near-identical “branded shards” competing primarily on cost, while L1 would remain expensive and capacity-constrained.

That assumption no longer holds. L1 is cheaper and expanding, whereas L2s are diverging faster than they are converging in their security models and use cases, despite Stage 2 decentralization.

The new path acknowledges that reality. L2s that custody ETH or Ethereum-issued assets should meet a minimum security bar, Stage 1 at least. And beyond that, they should compete on specialization and explicit guarantees rather than pretending to be interchangeable.

Native verification primitives and research on synchronous composability signal where Ethereum aims to make that easier, but these are trajectories, not deployed features.

The job description changed.

The minimum bar is to offer credible security when handling Ethereum assets. The differentiation bar is being the best at something, and being honest about the trust model.

The rollup-centric roadmap got upgraded to accommodate the reality that L1 is scaling and L2s are more diverse than the original vision anticipated.