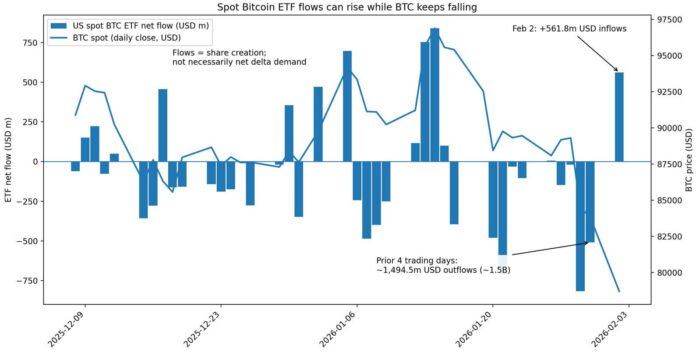

US spot Bitcoin exchange-traded funds recorded $561.8 million in net inflows on Feb. 2, ending a four-day streak of nearly $1.5 billion in outflows.

Investors could interpret the number as a return of conviction after punishing outflows, but Jamie Coutts, chief crypto analyst at Real Vision, offered a different read.

According to him:

“Aggregate ETF flows are not buying the dip. Net institutional demand is coming almost entirely from a shrinking group of Treasury-style buyers with remaining balance-sheet capacity. That’s not sustainable under continued pressure. A durable Bitcoin bottom likely requires these actors to reverse their positioning — not just slow their selling.”

The distinction matters because ETF inflows measure net share creation in the primary market, not whether the marginal buyer is taking directional Bitcoin risk.

A positive flow print can represent risk-on conviction or risk-off positioning dressed up as demand. The difference hinges on what occurs in the derivatives market immediately after those ETF shares are created.

Flows aren’t exposure

Exchange-traded fund creations and redemptions are executed by authorized participants, which are large institutions that keep ETF prices close to net asset value through arbitrage.

When an ETF trades at a premium or discount to its underlying holdings, authorized participants can profit by creating or redeeming shares. That activity shows up as “flows” even when the initiating trade is market structure-driven rather than a macro dip-buy.

More importantly, inflows can represent the spot leg of a delta-neutral basis trade.

Banque de France explicitly describes hedge funds exploiting the futures-spot basis by shorting futures and hedging with long spot exposure via Bitcoin ETF shares.

The central bank notes that basis ranges and annualized equivalents make this trade attractive when volatility and margin costs are stable. CME Group defines basis trading as the simultaneous holding of opposing spot and futures positions to create delta-neutral exposure, with returns arising from basis convergence rather than Bitcoin’s price movement.

In practice, this means an institution can buy ETF shares and immediately sell Bitcoin futures or perpetual swaps.

The result resembles institutional demand in headline flow prints, while being economically closer to a carry book than a risk-on bet. The institution earns the spread between spot and futures prices as they converge, clipping an implied yield subject to margin and risk limits.

Five reasons inflows rise without dip buying

Cash-and-carry or basis trades represent the clearest example.

Going long ETF shares while shorting futures or perpetual swaps to achieve basis convergence generates flows that appear bullish, even as net delta exposure remains near zero.

Authorized participant arbitrage adds another layer. Creations and redemptions happen because the ETF traded away from net asset value, not because someone wants Bitcoin exposure.

The flow is the settlement artifact of a pricing discrepancy, not a bet.

Liquidity provision and inventory rebalancing create similar distortions. Market makers may issue shares to meet secondary market demand while hedging elsewhere. The flow appears, but the price support vanishes if the hedge offsets the spot buying.

Cross-venue hedging can directly offset spot buying pressure. Spot purchases to create ETF shares can be matched by futures selling or options hedges, reducing the “price floor” effect even with positive flow prints.

Balance sheet-constrained buyers, who dominate marginal demand, create fragility.

If the primary bid comes from a smaller set of carry players, inflows become episodic and vulnerable to risk-off conditions. This is Coutts’ “not sustainable under continued pressure” thesis.

What the positioning data shows

The Commodity Futures Trading Commission’s CME Bitcoin futures report shows large gross longs and shorts among non-commercial participants, with sizable spread positions.

That’s consistent with systematic relative-value activity being present in the market, exactly what to expect if a meaningful portion of “institutional demand” is hedged rather than directional.

The Banque de France provides basis ranges and annualized equivalents that clarify the economics.

When the expected carry, calculated as futures basis minus financing cost, fees, and margin haircuts, is attractive and volatility remains stable, carry buyers scale the trade and ETF inflows rise.

When volatility spikes or margins increase, or when basis collapses, they de-risk, and flows can flip negative quickly.

This creates a forward-looking distinction. A genuine bottoming process would show basis compressing and futures shorts reducing through covering while ETF inflows persist.

That would signal that inflows are beginning to represent net delta demand rather than just carry.

A fake-out looks different: inflows persist but are matched by rising hedges in futures and perpetual swap markets.

The market gets flow headlines without durable spot support, and any renewed selling pressure forces an unwind.

Coutts’ claim suggests the second scenario dominates until proven otherwise.

When inflows actually matter

The clearest test of whether inflows reflect conviction rather than carry is to examine what’s happening in derivatives markets.

If ETF inflows are positive while hedges are unwinding, such as basis compresses, futures shorts, and spread positions fall, open interest behavior supports de-risking of carry books, then the inflows likely represent net new demand.

If inflows are positive while futures shorts build or remain elevated, open interest expands in ways consistent with hedging activity, and basis remains wide enough to justify the trade. The flows are plumbing, not positioning.

ETF premiums and discounts to net asset value offer another signal.

When the ETF trades close to NAV, creations are more likely to be mechanical inventory management or basis-trade execution rather than panic bottom-fishing by conviction buyers.

The Feb. 2 inflow of $561.8 million arrived after Bitcoin had already fallen below $73,000. The move pushed Bitcoin to its lowest level since the 2024 election, below its 2024 all-time high of $73,777.

Liquidations had hit $2.56 billion in recent days, according to CoinGlass data. Macro risk-off sentiment, driven by the Kevin Warsh Fed chair nomination and Microsoft’s Azure growth disappointment, had soured broader markets.

In that context, a single day of positive flows doesn’t prove buyers stepped in with conviction.

It proves that authorized participants created shares. Whether those shares represent directional exposure or the spot leg of a delta-neutral trade determines whether the flows provide price support or merely disguise carry activity as demand.

| If ETF inflows are… | And derivatives look like… | Most likely interpretation | What you’d expect next |

|---|---|---|---|

| Positive | Basis compressing, futures shorts/spread positions fall, OI flat/down, options skew normalizing | Conviction / net delta demand (dip buying) | Better spot follow-through; supports hold |

| Positive | Basis stays wide, futures shorts/spreads rise, OI up, downside hedging persistent | Carry / basis trade (delta-neutral) | Price can stay heavy; flows flip fast if volatility/margins worsen |

| Positive | ETF premium/discount moves trigger creations; derivatives unchanged | AP arbitrage / plumbing | Weak predictive power for direction |

| Negative | Basis collapses + OI falls | De-risking / carry unwind | Volatility spikes; sharper downside possible |

The sustainability question

Coutts’ framing of the remaining demand as coming from a shrinking group of Treasury-style buyers with finite balance sheet capacity points to a structural limit.

Basis trades are balance sheet-intensive. Institutions running these strategies face margin requirements, leverage limits, and risk concentrations that constrain how much they can scale.

If the marginal bid comes from this group rather than from conviction-driven allocators, then each incremental dollar of inflow requires more capital and increases fragility.

A durable bottom likely requires a regime shift in which these actors reverse their positioning, not just slow their selling, and in which unhedged directional buyers return in size. Until then, positive flow days can coexist with continued price pressure.

The flows measure plumbing. The price measures whether anyone is actually buying the dip.